Commodity Money

For centuries, people used commodity money. Commodity money is any commodity used as money (we’ll come to the definition shortly). People will be most familiar with the use of silver and gold as money but shells, beads, tobacco, pelts, and rice, to name a few other commodities have also served the purpose.

The obvious problem with commodity money, especially today, is that it’s bulky and can only be used to exchange for goods and services in person.

So, along came paper money, collateralised with first silver and then gold (let’s keep it simple). This era of monetary policy was known as the “gold standard”. It started in the early 19th century in Britain.

The international classical gold standard spanned the period between 1873, when Germany and the United States adopted it, to 1914 when WW1 broke out. Warring nations managed to con their citizens into not converting their paper money into the gold that backed it because they were spending all the gold on the war effort.

Many countries, led by Britain, returned to the gold standard in the 1920s but abandoned it again a decade later due to deflation.

And this is when the modern-era scam began. Countries realised that they could print their way out of economic depressions but not if they were constrained by the gold they held in reserve, and thus, “money creation” was born, not in the interest of the ordinary consumer, just in the interests of the banks (central and commercial).

Recognising that they could not control the economy (i.e. the money supply) without controlling the gold (that could still be reliably used instead of the fictitious paper money), in 1933, the US government stole all the gold from US citizens and nationalized all gold by ordering Federal Reserve banks to turn over their supply to the U.S. Treasury in 1934.

In the 1950s, there was a sort of return to the gold standard - the “gold exchange standard”, whereby international nations fixed their exchange rates to the US Dollar, which they could exchange for gold.

In the 1970s, once again partly due to war (Vietnam this time), the gold standard was dropped again and the modern era of “fiat” money was born.

Fiat Money

Fiat money is a type of currency that is not backed by a commodity, such as gold or silver. It is typically designated by the issuing government to be legal tender. Throughout history, fiat money was quite rare until the 20th century, but there were some situations where banks or governments stopped honouring redeemability of demand notes or credit notes, usually temporarily. In modern times, fiat money is generally authorized by government regulation.

Fiat money generally does not have intrinsic value and does not have use value. It has value only because the individuals who use it as a unit of account – or, in the case of currency, a medium of exchange – agree on its value. They trust that it will be accepted by merchants and other people.

Fiat money is an alternative to commodity money, which is a currency that has intrinsic value because it contains, for example, a precious metal such as gold or silver which is embedded in the coin. Fiat also differs from representative money, which is money that has intrinsic value because it is backed by and can be converted into a precious metal or another commodity. Fiat money can look similar to representative money (such as paper bills), but the former has no backing, while the latter represents a claim on a commodity (which can be redeemed to a greater or lesser extent).

Government-issued fiat money banknotes were used first during the 11th century in China. Fiat money started to predominate during the 20th century. Since President Richard Nixon's decision to suspend US dollar convertibility to gold in 1971, a system of national fiat currencies has been used globally.

Fiat money can be:

Any money that is not backed by a commodity.

Money declared by a person, institution or government to be legal tender, meaning that it must be accepted in payment of a debt in specific circumstances.

State-issued money which is neither convertible through a central bank to anything else nor fixed in value in terms of any objective standard.

Money used because of government decree.

An otherwise non-valuable object that serves as a medium of exchange (also known as fiduciary money).

The term fiat derives from the Latin word fiat, meaning "let it be done" used in the sense of an order, decree or resolution.

So, there we have our definition of money, modern fiat money, at any rate. It’s money, simply because “they” say it is - by “order, decree or resolution”.

But, that doesn’t mean you have to use it. You can accept anything you like in exchange for providing goods and services to the economy. People get confused with the term “legal tender”, which actually only relates to debt:

You might have heard someone in a shop say: “But it’s legal tender!”. Most people think it means the shop has to accept the payment form. But that’s not the case.

A shop owner can choose what payment they accept. If you want to pay for a pack of gum with a £50 note, it’s perfectly legal to turn you down. Likewise for all other banknotes, it’s a matter of discretion. If your local corner shop decided to only accept payments in Pokémon cards that would be within their right too. But they’d probably lose customers.

Legal tender has a narrow technical meaning which has no use in everyday life. It means that if you offer to fully pay off a debt to someone in legal tender, they can’t sue you for failing to repay.

What then, is fiat money really? Is it worth anything?

The answer is a resounding “nothing”. It’s a promise of nothing. It won’t be repaid, converted, or redeemed into anything useful. What you do get is the control of the central bankers to “stimulate” the economy by “money creation”, literally printing more paper notes. This results in inflation (higher prices for the same output) but not real wealth creation (not unless you’re right next to printing press at any rate - ask Mathew Crawford about the Cantillon Effect).

This process advantages "the elite" (defined by short network distances from the core of the Monetary Empire) whether or not their education and experience amounts to economically benefiting the world commensurate with their remuneration. Automatic and unearned accumulation of wealth is a major by-product of money printing, and this is what we call the Cantillon Effect.

And that’s why I say money, fiat money, is the biggest scam ever perpetrated. It’s a Ponzi scheme. It’s only worth what the next idiot is prepared to pay for it. They will try and distract you by pointing out the risks of other Ponzi schemes whilst they keep running their own, which makes all others irrelevant. Taxation is theft. But money creation is stealth tax which makes it worse.

The Solution - a Return to Commodity Money

The solution to a problem is often to stop being part of it. I assert that the same is true of money. If you recognise that money is the problem then stop using it. What does this mean in practice? Not much change actually. You can still exchange your goods and services (your productivity, your economic output, your contribution to society) but insist on anything but fiat money in return.

There are plenty of businesses providing you with physical silver and gold if you want to readopt commodity money and with the advances of modern technology, there are many reliable digital versions too (“representative money”) that overcome the historic issues associated with commodity money.

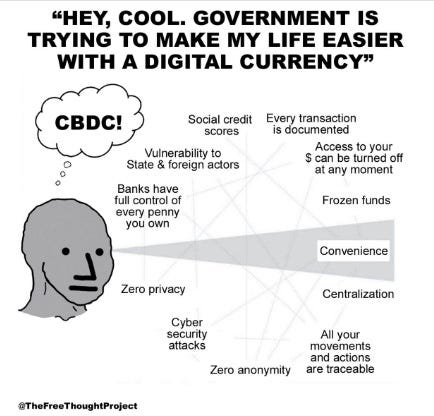

In fact, the technology (you know the one I’m talking about) is so useful that once again, the entire range of commodities, and even your time resource) can be used as money or currency. Pro tip: it’s the antithesis of central bank digital currencies (CBDCs).

All you have to do is establish communities of people with all the goods and services they need between them and adopt an alternative medium of exchange and store of value.

Be the Pokémon shop!

The only losers are the banks and the puppet governments and their precious international trade arrangements that benefit no-one else in society, just themselves. Sounds like a good deal to me!

"It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning."

Henry Ford

Hi Joel

I started looking at and researching the money system just before the global credit crunch. I've read and still got many books which describe money and how it operates. There are some common themes as well as differences.

Your point - "What then, is fiat money really? Is it worth anything? The answer is a resounding “nothing”. It’s a promise of nothing".

I don't think that's strictly true, governments back fiat money, and it is accepted for trading and payment of taxes. Some would argue that it's the very fact we pay tax in £'s which means it becomes ubiquitous.

You are correct that a business or an individual could use other forms of exchange, and this does happen. But, whether a government would accept other forms of payment is questionable.

Central Banks, The Bank of International Settlements and various governments exert enormous control via laws. One could say they use a form of legal violence.

Back in the 1930's, Wörgl created their own currency, which dug them out of the great depression. It was called the miracle of Wörgl. Ultimately, it was closed down via legal action from the Austrian Central Bank.

You say, "All you have to do is establish communities of people with all the goods and services they need between them and adopt an alternative medium of exchange and store of value".

This has been tried and is being done now, albeit in a small way. I think there are various reasons why they tend to fail, but it isn't easy to set up these systems in a way which keeps people using them.

I'm all for challenging the status quo, but I think it's helpful to understand this is a huge fight with plenty of vested interests who would like the status quo to continue.